UPDATE: NationsBenefits Acquires DeliverLean

As of Sept. 21, NationsBenefits has acquired DeliverLean, a food manufacturer specializing in health and wellness. The acquisition is part of NationsBenefits’ strategic vision to expand its healthy foods benefit offering to meet the ever-growing needs of health plans with Medicare Advantage and Part D plans.

As of Sept. 21, NationsBenefits has acquired DeliverLean, a food manufacturer specializing in health and wellness. The acquisition is part of NationsBenefits’ strategic vision to expand its healthy foods benefit offering to meet the ever-growing needs of health plans with Medicare Advantage and Part D plans.

DeliverLean’s food as medicine solution, which is being introduced with the NationsMarket brand name, will help MA plan members and low-income populations to live healthier by addressing nutrition and providing specific and actionable direction to motivate behavioral changes in their diets.

With a growing demand for home-delivered, nutritionally focused products such as groceries, fresh produce, and prepared meals, NationsBenefits can help Medicare beneficiaries achieve better health and wellness by providing them with convenient and easy-to-use products. The healthy foods benefit offering is designed to improve members’ health and satisfaction while reducing overall health care costs.

DeliverLean founder Scott Harris will continue to lead this division, as a part of NationsBenefits.

The Deliver Lean acquisition is expected to close in the third quarter of 2022.

NationsBenefits provides supplemental benefits, flex cards and member engagement solutions for health plans.

For updates on news that affects the food and beverage industries, subscribe to Gourmet News.

Blue Apron Adds Snacks, Light Meal Options

Blue Apron has expanded on convenient meal options beyond dinner that will be featured on its Add-ons menu, available to order now. Created to take the stress out of weekday planning in preparation for one of the busiest seasons of the year, the new Add-ons feature kid- and adult-approved recipes, perfect for an after-school snack, packable lunch, simple dinner or somewhere in between.

Blue Apron has expanded on convenient meal options beyond dinner that will be featured on its Add-ons menu, available to order now. Created to take the stress out of weekday planning in preparation for one of the busiest seasons of the year, the new Add-ons feature kid- and adult-approved recipes, perfect for an after-school snack, packable lunch, simple dinner or somewhere in between.

“Expanding the variety of our menu options to meet the needs of families and on-the-go customers continues to be a category we are focused on, especially as summer winds down and back-to-school season approaches,” said Josh Friedman, Blue Apron’s chief product officer. “Our customers look to Blue Apron to help solve for different meal occasions throughout the week. We continue to iterate on our offerings to create recipes that complement one another, but also fit into more non-traditional meal times.”

Designed to be ready in 30 minutes or fewer, the new Add-ons are a quick and fun take on classic recipes that can be prepared ahead of time or on the spot. They include simple dishes with an elevated twist, like a savory, pancetta grilled cheese sandwich with caramelized onion between sourdough bread. Additional options include French bread pizza, antipasto wraps and a delicious snack board.

“As we move into fall, our culinary team wanted to offer customers a series of recipes that could be utilized and enjoyed in a variety of ways throughout the day,” said John Adler, Blue Apron’s vice president of culinary. “The new Add-ons function great as stand-alone meals, but they’re also customizable by adding, for example, an à-la-carte protein to our pesto pasta, allowing customers to create a meal that works for their taste buds and dietary preferences.”

The new Add-ons are part of Blue Apron’s offerings designed with convenience and ease in mind on the days when time and planning is limited. Other offerings include Ready to Cook recipes that require no knife work or chopping, Heat & Eat microwavable meals and Fast & Easy sheet pan and one-pot recipes.

Blue Apron’s offerings are available on a rotating basis through their website and mobile app, along with non-subscription options available on Blue Apron’s Market and Walmart.com. To learn more about Blue Apron’s Add-ons, visit cook.ba/add-ons.

For updates on the food and beverage industries, subscribe to Gourmet News.

Inflation: Americans Fear Losing Lifestyle, Change Food Shopping Habits

Nearly half of Americans (45 percent) feel like they can’t afford their previous lifestyle and 76 percent of American consumers say their family has changed how they buy food with prices on the rise. In addition, two-thirds (66 percent) are more mindful of how they are spending their money. These findings are part of a new consumer sentiment survey on inflation commissioned by NCSolutions, a leading company for improving advertising effectiveness.

Nearly half of Americans (45 percent) feel like they can’t afford their previous lifestyle and 76 percent of American consumers say their family has changed how they buy food with prices on the rise. In addition, two-thirds (66 percent) are more mindful of how they are spending their money. These findings are part of a new consumer sentiment survey on inflation commissioned by NCSolutions, a leading company for improving advertising effectiveness.

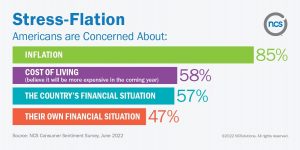

Eighty-five percent of Americans are very concerned or extremely concerned about inflation and almost unanimously (93 percent) they said we’re in an inflationary time. On the same economic theme, over half (57 percent) are concerned about the country’s financial situation, while 47 percent say they’re concerned about their family’s financial situation. Eight out of 10 or 83 percent of Americans expect the cost of living will become somewhat more or much more expensive in the coming year. Sixty-five percent of Americans agree with the statement ‘my income has not increased as fast at the cost of food, beverage and personal care products.

“For the second time in a little over two years, consumers are pivoting to new purchasing behaviors at the grocery store,” said Alan Miles, CEO, NCSolutions. “Since the start of the pandemic, they’ve been swapping their favorite brands for what’s available. Today, though, value is the centerpiece more often than availability, consumers are selecting brands and products to stretch their budgets as far as possible. CPG brands that meet customers where they are both in this inflationary moment and as prices ease have the best shot at keeping them for the long-term.”

“For the second time in a little over two years, consumers are pivoting to new purchasing behaviors at the grocery store,” said Alan Miles, CEO, NCSolutions. “Since the start of the pandemic, they’ve been swapping their favorite brands for what’s available. Today, though, value is the centerpiece more often than availability, consumers are selecting brands and products to stretch their budgets as far as possible. CPG brands that meet customers where they are both in this inflationary moment and as prices ease have the best shot at keeping them for the long-term.”

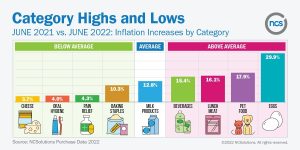

NCSolutions’ proprietary purchase data, which reflects the buying trends of consumers for CPG products, shows an almost 13 percent price increase on average. In a six-year price trend analysis, we see that price increases in 2022 are pacing at an accelerated rate compared to other years. The survey findings bear this out with 58 percent of consumers believing the cost of living will be much more expensive in the coming year and 71 percent feeling the U.S. economy is declining.

On a consumer packaged goods category level, there are wide variations in percentage increases.

Compared to one year ago, 6 in 10 Americans believe CPG product packaging has gotten but costs the same. Consumers still feel the strain of supply chain issues as 69 percent say there are fewer items of the same product on the shelves. Thirty-six percent of Americans said there is less variety of brands available on the shelf today compared with one year ago.

Over half (53 percent) of American consumers say they find basic food staples more expensive; 40 percent believe a recession will occur in 2023. For almost half of consumers (46 percent), this means buying fewer non-essential items on the food aisle, or for 43 percent, it means buying only the essentials. Seventy-one percent of Americans say the increased price of groceries is straining their savings. For other American consumers, increased prices on the grocery aisle mean seeking out less expensive brands (45 oercent). Other ways consumers are coping with the increased price of groceries are loading up the pantry (27 percent) or freezer (26 percent) or shopping closer to home (24 percent).

Over half (53 percent) of American consumers say they find basic food staples more expensive; 40 percent believe a recession will occur in 2023. For almost half of consumers (46 percent), this means buying fewer non-essential items on the food aisle, or for 43 percent, it means buying only the essentials. Seventy-one percent of Americans say the increased price of groceries is straining their savings. For other American consumers, increased prices on the grocery aisle mean seeking out less expensive brands (45 oercent). Other ways consumers are coping with the increased price of groceries are loading up the pantry (27 percent) or freezer (26 percent) or shopping closer to home (24 percent).

When it comes to consumers’ preferred brands, they have to make tough choices. Sixty percent of consumers seek less expensive alternatives when their favorite brands reach a price beyond their budget. Forty-six percent of consumers plan to go without their favorite brands, and 43 percent of consumers look for sales to offset the cost. In the survey, respondents could select multiple ways they react.

“Though it may be tempting to pull back on advertising, a more effective strategy is to recognize and respond to consumer ‘stress-flation.’ Brands have an opportunity now to build loyalty and attract new customers with empathetic marketing,” said Leslie Wood, Chief Research Officer, NCSolutions. “We’re heading into a period of heavy CPG purchasing moments, such as back to school and the approaching holidays. Compelling, well-targeted advertising is a proven strategy for increasing brand equity and sales both in the short- and long-term.”

Respondents were asked, “When shopping for groceries, which products are most important.” The majority ranked:

- Affordable products that provide a clear value for my money

- Finding food products that feed their families for several meals

- Products they know their families will enjoy eating

The online survey of 2,141 respondents was fielded from June 17- 20. Responses presented in this survey were weighted by location, education, income and other demographics to be representative of the overall population.

For more updates on the food and beverage industries, subscribe to Gourmet News.